Table of Content

High local affordability makes the $726,200 ceiling apply statewide for single unit homes. Dual unit homes have a limit of $929,850, triple unit homes have a limit of $1,123,900 & quadruple unit homes have a limit of $1,396,800. Home buyers who are borrowing more than the above amounts to purchase premium properties in hot markets like Austin will likely need to obtain a jumbo mortgage. Jumbo loans typically have a slightly higher rate of interest than conforming mortgages, though spreads vary based on credit market conditions. Start by using the customized rates from lenders quoting on Zillow. When ready, contact lenders with the best refinance rates.

He has reported on mortgages since 2001, winning multiple awards. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. This is not an offer to buy or sell any security or interest. Working with an adviser may come with potential downsides such as payment of fees .

Texas ARM Loan Rates

When compared with the rest of the country, Texas’ mortgage rates come in slightly lower than the national average. The median cost of property in the state is also lower than the national average, which could make buying a house in Texas an affordable option. Adjustable-rate mortgages, also called ARM loans, have interest rates that can increase during the course of the loan. However, the total amount of interest you pay on a 15‑year fixed-rate loan will be significantly lower than what you’d pay with a 30‑year fixed-rate mortgage. You should always get a customized quote when comparing mortgage loan options.

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own. Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs.

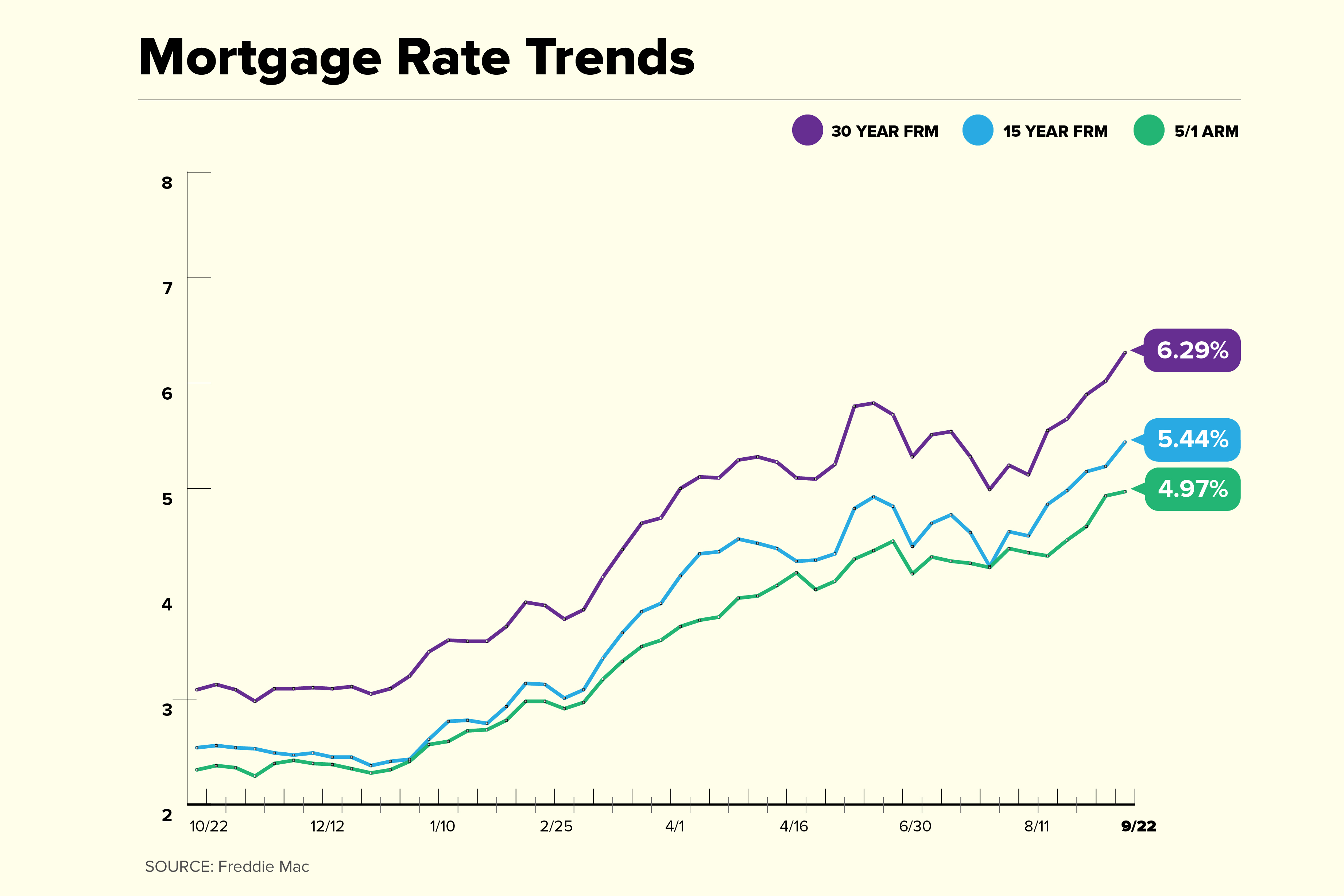

Mortgage Rate Trends

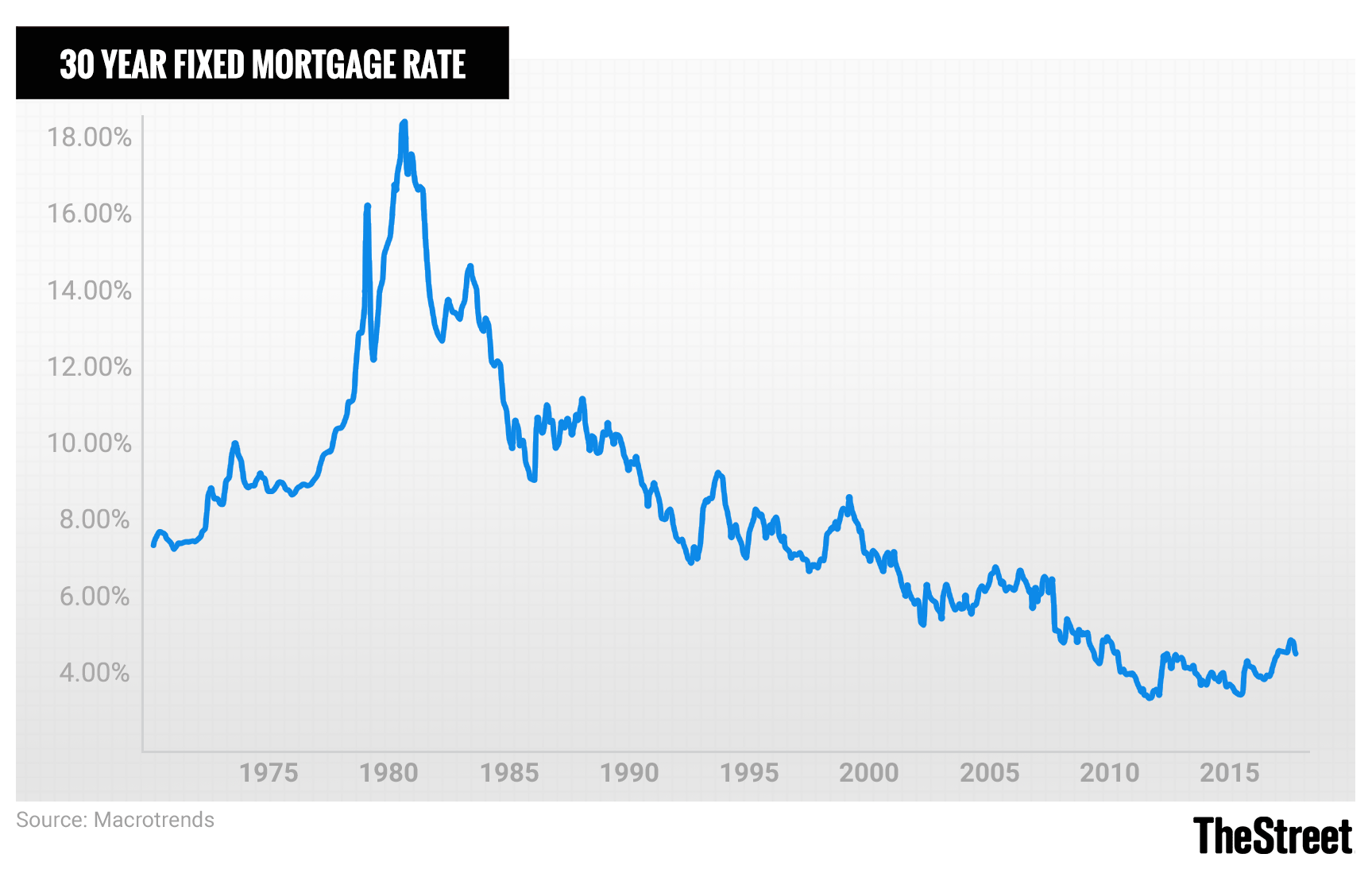

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So it’s important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs. Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

The property group calculates the selling price of the median home in the metro area to be $237,000. Residential Strategies, a housing analyst in Dallas, calculates that median home prices in the area have risen by nearly $100,000 in six years. Your monthly payment may fluctuate as the result of any interest rate changes, and a lender may charge a lower interest rate for an initial portion of the loan term. Most ARMs have a rate cap that limits the amount of interest rate change allowed during both the adjustment period and the life of the loan. Check the “Military/Veteran” above to get current mortgage rates for VA loans.

What are today's Texas mortgage rates?

As inflation slows, the housing market is back into balance. Home prices are not skyrocketing like they were in the height of the pandemic. Home buyers will see less competition in the market and home prices that are more aligned with current market values. You will need to list the debts you have which helps the lender understand your DTI ratio, which is vital to determining how much of a mortgage loan you can afford. A lender will run a hard credit check to look at your current score and the last several years of your credit history.

Any discount points purchased will be listed on the Loan Estimate. This applies only to “qualified” second homes, meaning you don’t rent it out, or you do rent it out but also use it yourself for a certain period of time each year. You can also deduct combined property taxes up to $10,000. Mortgage rates are somewhat higher on second home mortgages — by as much as 0.5 percent, 0.75 percent or 1 percent more. This is in part to compensate for the risk of a second home, which you’re much more likely to walk away from if you weren’t able to make payments compared to your primary residence.

You will purchase up to one mortgage discount pointin exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points. The home price you can afford to buy based on household income in Waco is 180% of the median home value which means housing prices are average. Waco ranks 212 out of 254 counties in Texas and 2,121 out of 3,142 counties in the United States for housing affordability. Home buyers with mortgages in high-risk areas are required to buy flood insurance. Most flood insurance policies are sold by the United States federal government through The National Flood Insurance Program.

Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers (our "Advertisers"). Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. The table below is updated daily with Texas mortgage rates for the most common types of home loans. Compare week-over-week changes to mortgage rates and APRs in Texas.

The state's large area presents many options that can please different types of buyers. The lowest prices will be found in the Southwest, along the state's border with Mexico. Although home values increase moving north, excellent values can still be found, especially when compared to median incomes. Equity requirements differ by loan program and property type. Generally, rate-and-term refinances have fewer restrictions on equity requirements, cash-out refinances have tighter equity restrictions.

Under non-recourse guidelines, a mortgage company can only pursue the collateral of a loan in the case of a default. A recourse loan, on the other hand, allows the lender to pursue other assets besides collateral if the borrower defaults. The median home value in the San Antonio metro area is slightly higher than $165,000.

Greg West was great to work with as well as his processor Terra Dwyer. They were both in constant communication with me throughout the entire process from loan application to closing. I also received very quick responses to my e-mails regardless of the time of day. I would definitely recommend Greg and his team to my friends and family. Most common refinances are rate-and-term but you can also choose from cash-in, cash-out or streamline refinancing to suit your needs.

If you work in public service, you may qualify for the Homes for Texas Heroes programs which provides a 30-year fixed-rate mortgage and down payment assistance up to 5 percent of the loan amount. Teachers, police officers, veterans, firefighters, and corrections officers are among the eligible applicants. USDA loans are for low to moderate-income families who don't qualify for the above loans.

No comments:

Post a Comment